by Georole Ltd | May 6, 2023 | land survey

what is a site planning survey?

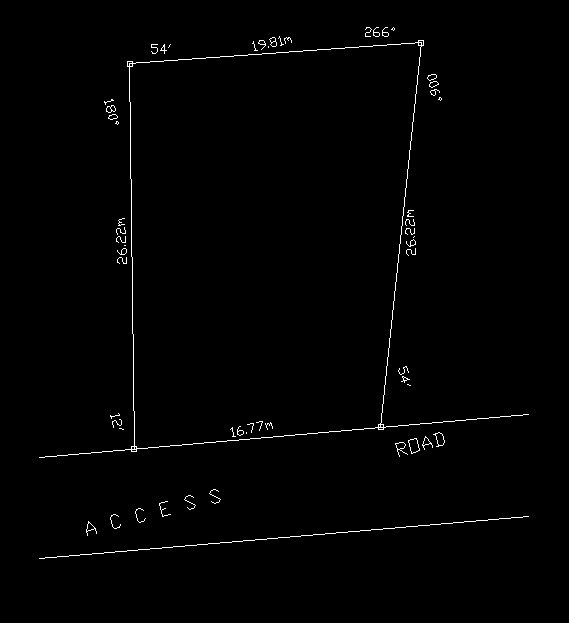

A site planning survey is a survey that uses a combination of both boundary and topographic surveys. This is used for the preparation of a site plan to be used for designing building improvements or land developments. It is possible that this may also include a subdivision survey, which would divide undeveloped land into various things. These include blocks, lots, streets, parts and more in accordance with State Laws and County or City ordinances. Read more.

when do you need a site planning survey?

As mentioned above, Site Plan Surveys are most often requested to legally obtain building permits for improvements for a property. There are other reasons to obtain this survey besides obtaining a permit. For example, if the site is in a flooding area, an engineer needs to look at a site plan so they can come up with a land grading strategy. A Site Planning Survey also serves as a measure of precision to make sure the building or addition is being built correctly. Whenever you are planning for some sort of improvement that interacts with the land, from add-ons to driveways to below-ground pools, a Site Plan Survey is a good idea, even if your local authorities do not require it.

who to hire as your surveyor?

As a result of experience in surveying, GeoRole Surveying is your best site planning expert. We are located in Kilifi, Coastal region of Kenya and our surveyors are licensed to service you.

Our survey team is the premier Site Planning Surveyors in Kenya. Therefore, Georole will deliver a fast turnaround, in comparison to our competitors, when it is time to execute a survey on your property.

We take pride in every survey we deliver to our clients. How do we achieve this? By providing exceptional service, industry-leading quality of work, and competitive pricing. Our surveyor team is the best nationally.

Contact us today or order a Site Planning Survey now to find out how our team can go to work for you!

by Georole Ltd | May 6, 2023 | land survey

Are you aware what a land surveyor does or what land surveying is? Basically, surveying is the technique, professions, art and science of determining the terrestrial or three-dimensional position of a point and the distances and angles that are measured between them. This technique is used in order to establish the size of a plot of land and the buildability of it.

A land surveyor is an individual with the important task of verifying property lines so that you don’t build anything where you are not allowed to. To make these verifications, surveyors go out into the field to search for original property markers on the land (these are usually underground and contain details about who originally surveyed the land).

Land surveyors also do a lot of measurements and calculations around the property and the neighborhood. Plus, they search for and review city, county and state property records.

There are many reasons why you would need a land surveyor and below are a few examples:

- When purchasing or selling land

- Prior to building a structure

- Resolving a boundary dispute

- Verifying a tax assessment

As you can see, the list of reasons why you need a land survey can be endless. Therefore, hiring a land surveyor is one of the first steps you should take when buying land or building a structure on your property. Look no further than Georole Surveying Team, Inc. for all of your land surveying needs.

conclusion

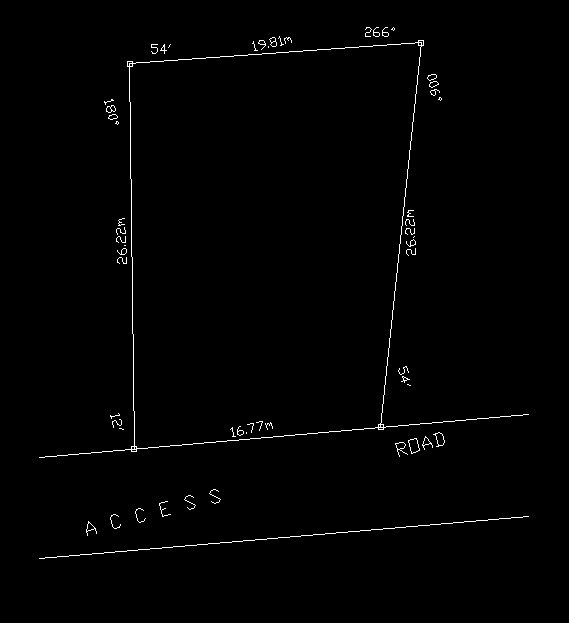

Land survey is a professional drawing that identifies property boundaries and provides the location of any structures located on the property. Land surveys are extremely important and a necessity for any land owner or prospective land owner. The land survey drawing will depict all corners of the property and will be marked on the property by a licensed land surveyor. You will use the drawing document and physical markers on the property to establish your property lines or building site.

by Georole Ltd | May 6, 2023 | land survey

Homebuyers may need to get a property survey before they close on their new place because when buying a home, there’s a certain amount of work required in between having your offer accepted and actually moving in.

The reason why property surveys may be necessary is to determine and confirm land boundaries. Examples would be the parcel of land a home sits on, and any sub-surface improvements, like a septic tank or well. They also identify other types of restrictions and conditions that apply to the legal description of a property.

This kind of survey will probably be needed whether you’re buying a new home or building an addition onto a property you already own.

what is property survey?

A property survey is all about defining what belongs to you and what doesn’t. This survey is conducted to determine or confirm land boundaries that are already established. For example, if a developer consider to put up a fence, he/she will need and want to know exactly where his/her property ends and their neighbor’s begins.

This survey also identify other types of restrictions and conditions that apply to the legal description of a property, including easements or encroachments.That’s what a property survey will help you determine. Surveys detail how your property is defined in an official, legal capacity. Instead of guessing where your property lines are, you have a document that has it detailed for you.

Just incase you will need a property survey, do not hestate to contact georole surveyors

by Georole Ltd | Apr 23, 2023 | land survey

The important key steps to follow in purchasing land includes; land identification, search, sale agreement, transfer, stamping and the registration of the transfer.

Land Identification

The prospective buyer identifies a piece of land that meets their criteria including size, location, soil type among other factors. Are you looking for a land to buy? click here to identify a land of your choice.

Search at the lands registry

- Carry out an official search at the county registry. The search indicates the ownership and status of the land. One needs to have a copy of the title to the land that you intend to do the search.

- You will have to fill a search application form and attach on it single copies of the title deed, ID card and PIN certificate and pay Kshs.500/- at the registry and get an official receipt.

- The search will give you the following information; The registered owner, Its size, Any encumbrances against the land, for instance cautions, caveats. It will further show the title and search numbers, date the search was done, nature of title (freehold/leasehold), approximate area in hectares, name and address of proprietor and whether a title has been issued. A title with any unresolved issues of the above is not transferrable.

- The search results must be signed and sealed by the registrar. If all is clear, then you may proceed to the next step which is writing a sale agreement.

Sale agreement

The purchaser may appoint a lawyer to represent him in the signing of the agreement. The sale agreement is prepared by the seller’s lawyer and it indicates the terms of sale including the names of the buyer and seller, price of the land, mode of payment and documents to be supplied by the seller to facilitate registration of the transfer of land to the buyer.

At this point, the buyer may be required to pay a deposit with the balance payable within 90 days after signing of the sale agreement. After the parties have signed the sale agreement, the document must then be stamped to make it legally binding.

Transfer and procurement of completion documents

- The transfer document is usually prepared by the buyer’s advocate and approved by the seller’s lawyer.

- The seller is supposed to procure the completion documents at his costs, including the: original title deed, 3 copies of transfer of land duly completed by the seller, ID Card, certificate of registration of the seller and PIN certificate, 3 passport size photos of seller (if company, photos of two of its directors) land rent clearance certificate (for leasehold

land) rates clearance certificates, and consent to transfer and valuation form duly completed by the seller.

- The document should also be signed by the buyer who is also required to produce copies of his ID card, PIN certificate and passport photos.

Stamping the transfer

- The buyer then applies for the valuation of the land by the government valuer using valuation form duly completed by the seller. Lands office will use these documents to determine stamp duty payable.

- The stamp duty should be paid to the commissioner of domestic taxes usually through the National Bank or any other appointed bank.

- Once the payment is done, the buyer should lodge the documents at the lands office for stamping with duty.

- Thereafter, the buyer should book the following documents for registration: Title deed; land rent and rates clearance certificates, valuation report, consent to transfer, stamp duty declaration and pay-in-slip.

Registration of the transfer (final of the steps to follow in purchasing land)

This is the last process of the land purchase and it involves the registration of the transfer in favor of the buyer.

“Enjoyed this article? Show your support by buying us a coffee ☕”

by Georole Ltd | Feb 25, 2023 | land survey

Land registration is any of various systems by which matters concerning ownership, possession, or other rights in land are formally recorded (usually with a government agency or department) to provide evidence of title, facilitate transactions, and prevent unlawful disposal.

Picture this: you’re browsing your favourite social network, and you spot an advertisement for a piece of ‘prime property’, ‘good for development’, with a ‘ready title deed’, and what’s more, the price is just within the limits of your pocket! You laugh and think to yourself, ‘Kwani someone is spying on me? Wasn’t I just telling someone the other day how I need to buy a piece of land?’ (Let’s also assume that they’re genuine as well). You call the number provided, set up an appointment and in a few days you’re seated in a plush office within the city, ready to begin the process. They issue you with a document known as a Letter of Offer, or Heads of Terms, which contains all these legalese terms and also requires your signature, and the attestation of an Advocate, before they can proceed. What next?

land registratin process

First off, we advise you to retain the services of an Advocate to act on your behalf as the buyer. You can do this through referrals or through searching for the one closest to you on the LSK Search Engine here or here. In some instances, it is possible to have one Advocate act for both buyer and seller, provided there will be no conflict of interest. The purpose of retaining an Advocate is to have them break down the legalese into simple terms as well as secure your best interests in the transaction. Once you’ve retained an Advocate, their actions include:

- obtain an official postal search of the property, to ascertain, among other things, the legal ownership of the property, that the title is clean, that there are no impediments to transactions on the property (these are called encumbrances), and that the seller has the right to sell the property.

- attest the Offer Letter/Heads of Terms document you received, signifying your acceptance of their offer to buy the property from the seller and your willingness to proceed with the transaction. It is important to note that this document is not a binding contract, but denotes the intention of the undersigned parties to enter into a binding contract. To this end, at the top of the document, there should be the words ‘Subject to Contract’ written clearly (and in uppercase, if possible).

Note: The required documents to obtain an Official Search are a copy of the Title, which the buyer’s Advocate (your Advocate) gets from the seller or his Advocate, and a copy of the National Identity Card of the person applying for the search. This could be the Advocate themselves or one of their employees. The search is done at the applicable Land Registry Office. Let’s assume our piece of land is situated in Nairobi and its environs. The search would then be conducted at the Central Registry, which is situated at Ardhi House. Once they present themselves at the Registry, they will fill the required Land Search Application Form, and pay the search fee, which is K.Shs 500. They will then present the Form, Copy of Title and ID, and the receipt issued at the Registry Counter for the search to be conducted on the property. This process takes roughly two to three days, after which you can obtain the Official Search.

- The seller’s Advocate will then draft an Agreement of Sale and forward it to your Advocate for correction (where necessary) and execution (signature) within 14 days. Within these 14 days, the buyer’s Advocate (your Advocate) will draft a Transfer Instrument and forward the same to the seller’s Advocate for correction and execution, while also requesting them to provide them with Transfer Documents (also known as Completion Documents) for verification. The basic Transfer Documents are:

- The original Certificate of Title (or Lease, if applicable) for the property;

- Consent to Transfer from the National Land Commission (this takes roughly nine to twelve days to process, at a fee);

- Land Rent Clearance Certificate for the property, together with the Land Rent Payment Receipts;

- Land Rates Clearance Certificate from the relevant County Authority, together with the Payment Receipts;

- The Transfer Instrument, duly executed by the seller;

- The duly executed Sale Agreement, outlining the parties to the sale, the full description of the property, Advocates’ details, the selling price, how and when it is to be paid (including date of receipt of each instalment, where necessary), deposit amount and how it is to be held, date of completion and mode of termination of agreement, and what may lead to the said termination;

- Certified copies of the Seller’s I.D. and PIN Certificates;

- An affidavit of Spousal Consent to Sell by the seller’s spouse, or an Affidavit by the Seller stating that no spousal consent is necessary for the transaction.

Payment of Stamp Duty

Stamp Duty is a key requirement during land registration. It is tax payable, according to the Stamp Duty Act, on all land transactions involving change of ownership either through consideration (payment), gift, or partition of land, except where otherwise stipulated by the law. There are two stages of payment of Stamp Duty, the assessment and valuation stage, and the actual payment of Stamp Duty. The assessment and valuation stage of this process is usually handled by the Buyer’s (your) Advocate. The documents required and prepared by the Advocate are:

- The requisite application for valuation form in quadruplicate;

- A copy of the Official Land Search;

- The executed Transfer document;

- A certified copy of the Deed plan/route sketch/site map (as the situation requires);

- The buyer and seller’s passport pictures.

These documents are to be presented at the rightful counter at the Lands Office for assessment, with one copy of the application form retained by the applicant for follow up purposes. The assessment of the presented documents take about a maximum of two weeks.

Site visit of the property. The physical presence of the Government Valuer and the Registered Owner at this visit is mandatory. The purpose of this visit is to ascertain the actual value of the property vis a vis the declared value or the selling price. This is where assessment and valuation of the property takes place.

A brief valuation report is entered into the application form (above), and together with the valued Transfer document, is returned to the Lands Office for collection by the applicant. The Assessed Value and Duty Payable is indicated on the first page of the Transfer document.

Once valuation and assessment are complete, we move to the actual payment of Stamp Duty. It is usually charged at 4% of the value for leasehold properties situated within cities, towns or urban areas, and 2% of the value for freehold properties situated outside of cities, towns or urban areas. Stamp Duty must be paid within 30 days of assessment of value. Note: In Kenya, Stamp Duty is paid on the KRA’s iTax platform.

The Seller, individually or through their Advocates, using the Seller’s iTax profile, generates a Payment Registration or PRN form, for the payment of Capital Gains Tax, which is the tax on whatever profit made on the transaction – the difference between the selling price and the assessed value (known as the Capital Gain). This form has an acknowledgement number indicated on it. The form is then presented to a bank of choice by the Seller’s Advocate or agent for the payment of the amount indicated as CGT. Upon payment of CGT, the Buyer’s Advocate obtains the PRN form from the Seller’s Advocate, and using the acknowledgement number therein, generates a separate PRN form using the Buyer’s iTax profile for the payment of Stamp Duty. This PRN form is also presented to a bank of choice by the Buyer’s Advocate for the payment of the indicated amount.

Once Stamp Duty is paid, the assessed documents are presented at the relevant Registry Office by the Buyer’s Advocate or their agent for franking. Franking refers to the placement of an official mark by the relevant authority (in this case, the Collector of Stamp Duty) to indicate that the required tax has been paid or does not need to be paid (i.e., the instrument is exempt). The required documents for franking are the Transfer Instrument and its two Counterparts (Original copies), and the Stamp Duty Payment Receipt (both the form from iTax and the bank receipt). The franking process takes two to four days.

Once all these processes are complete, we can now proceed to registration. This is done by the Seller’s Advocate. An Application for Registration form (also known as a Booking Form) is filled, in triplicate while enclosing:

- The Transfer Document in triplicate;

- The Official Search Certificate;

- Consent to Transfer from the relevant authority;

- The Land Rent Clearance Certificate;

- The Land Rates Clearance Certificate;

- Certified copies of the I.D.s and PIN Certificates, together with passport pictures, of both the buyer and the seller.

Upon presentation at the Registry Counter, an application fee of K.Shs. 500 is charged and collected. The officer at the counter then verifies that the documents enclosed are those declared on the form, stamps all copies of the Booking form and returns one copy of the form to the applicant, with a Daybook Number clearly indicated on it. (The Daybook Number is the entry of that particular transaction, in this case, booking for registration, recorded in the events of that particular counter on that day, as they occur. The time is also recorded).

The Registration process should take 7 – 21 days, and the Advocate or their agent ought to keep following up at the counter using the Daybook Number provided.

Finally, once the documents are ready, the Advocate or their agent presents their copy of the Booking Form at the counter and receives the Transfer Document, in triplicate, registered in favour of the Buyer, together with a Certificate of Title, in the Buyer’s name. These documents are later given to the Buyer for their records and safekeeping.

Conclusion and Recommendation

The process outlined above details the most basic procedure followed while purchasing and registration of land, and we can also replace the term ‘land’ with ‘apartment’, although there would be an additional process included should one be using financing from a lender. Remember, always seek legal advice from a qualified Advocate or Land experts before getting into any contract or agreement so as to properly secure your rights and to better understand all the issues involved in the transaction.

Now, go forth and buy that property and check off ‘buy land/property‘ from your bucket list!

“If you found this article helpful, consider supporting our work to keep creating valuable content.”